Despite the Drop, the Risk Factors That Drive the Gold Price Higher Remain

Despite an ever-more-confusing international situation, the gold price has failed to benefit from mounting tensions.

Even the analysts and brokers have been ignoring the precious metal lately. Gold experts, who not even eight months ago expected gold to post its highest gains of the past five years, are baffled. (Source: “Gold seen at highest annual price for five years in 2018: GFMS,” Reuters, May 8, 2018.)

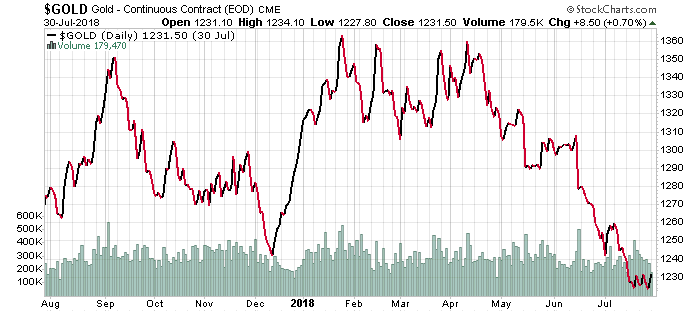

Gold appeared to be heading back toward $1,400 per ounce. It was more than reasonable to expect a boost to $1,500 per ounce before the end of 2018, yet the chart has been disappointing. Far from going higher, the price of gold is at its lowest.

Chart courtesy of StockCharts.com

Gold is the victim of a tug-of-war between what appears to be a stronger economy and higher U.S. dollar on one side, and the off-and-on threat of a major international war on the other.

When gold prices were trending higher for a while, supporting bullish expectations, it was due to specific events. Or rather, it was due to specific threats.

Don’t Treat Gold Like a Day Investor Would, Go for the Long Haul

Between April and May, President Donald Trump put the world on high alert with actions and words that undermined relations with Russia, Syria, North Korea, and Iran. The tensions remain, but meetings with Kim Jong-un and Vladimir Putin have softened them (or so the media has interpreted it). Yet it’s only a matter of time before they resume.

Trump is preparing for the November midterm elections. He’s making sure he does everything he promised in order to get the Republicans re-elected.

One of those promises was, in fact, to “talk to Putin.” And he can check that off his list. Yet nothing has really changed.

Even when it comes to Russia, despite rumors of another summit in the works in 2019, there are forgotten issues that could flare up the White House-Kremlin dialogue to the point that it becomes an argument.

One of those issues is the investigation into Malaysia Airlines Flight MH17. That was the airliner that crashed in eastern Ukraine in July 2014—in an incident that an international investigation blames on a Russian military unit. Some say Russian President Vladimir Putin himself was aware of what happened.

And that’s just a single incident. There are other pending issues, from Syria to Iran, that remain as volatile as ever.

In gold price terms, this means that patience is the path to a reward. Precious metals and resources are not for day traders.

There Is a Silver Lining: The Long-Term Trend Is Bullish

However bearish the expectations might be for gold, 2018 has shown that medium- and short-term predictions miss the mark.

Gold may be trending toward $1,200 per ounce in August, yet—even at that level—it would still be $100.00 higher than it was in January 2017.

Indeed, even for the less patient investors, the gold market could produce some pleasant surprises, such as a price of $1,400 or higher before 2019. Just don’t expect miracles (not yet, anyway).

The Dollar Factor

The price of gold is due for a rebound. One of the reasons is that you can blame its recent drop on one specific factor. If you guessed the higher U.S. dollar, you’re right.

Higher interest rates—or better yet, the expectation of higher interest rates—has been driving the dollar higher. This has reduced gold’s appeal as a safe-haven investment.

But the perceived strength of the U.S. dollar is relative. As high as the dollar is moving, mostly on fumes, U.S. debt (already at more than $21.0 trillion) is climbing.

In other words, the perceived strength of the U.S. economy is just that, a perception, given that the government is borrowing at its highest level in a decade. (Source: “US government borrowing soars to highest level since recession, despite strong economy,” South China Morning Post, July 31, 2018.)

Considering that Treasury yields are rising, the long-term situation would appear to favor safe havens and lower-risk investments rather than equities.

In other words, even without the benefit of international tensions, the gold price momentum is due to swing on the bullish side.

The End of QE Is a Risk Factor

And while higher interest rates should contribute to strengthening the U.S. dollar, the Federal Reserve has already made its announcements about the rate increases. Therefore, the market has already absorbed whatever premium to the dollar there was on the news.

Moreover, the dollar’s rise won’t look as impressive once the euro also starts climbing as quantitative easing (QE) ends in the eurozone as well.

And the end of QE in the eurozone could prove rather premature, triggering a financial crisis—not unlike the one in the United States

The end of QE on both sides of the Atlantic will raise volatility in stocks and the economy. That’s when gold will return to fashion.

Therefore, consider 2018 a time for potential gold accumulation ahead of a sharp rise in gold prices in 2019, as many economic risk factors will come to a boil.